Generative AI for accounting has suddenly made its way into accounting as a revolutionary technology that is changing the way financial professionals work across the spectrum of companies.

Generative AI, unlike rule-based automation tools, does not simply take over a task but creates its content, does a complex pattern analysis with incredible accuracy, and gives insights that would have been impossible without manual analysis by the most senior financial experts who have been putting in the effort for ages.

This guide explains how the use of generative AI accounting is turning the whole process upside down, starting from bookkeeping and ending with fraud detection.

What is Generative AI in Accounting?

Generative AI accounting does not just improve the prior artificial intelligence; it opens a completely new gate in the field of AI. To put it in other words, the difference between generative AI and traditional AI is like the difference between a chemical assistant who performs only a few operations and a creative assistant who drafts documents, analyzes trends, and suggests innovative approaches to complex problems.

When we talk about generative AI in finance and accounting, we mean systems that rely on large language models and cutting-edge neural networks.

- Key Differences: Conventional Artificial Intelligence shines in defined areas like invoice reading or assigning transactions to categories. On the other hand, Generative AI offers more convenience; a single system can compose audit reports, do statement analysis, respond to client queries, and spot anomalies all at once, with no specific programming done for every task.

Supervised learning finds patterns, but it necessitates a long training process. Generative AI is the technology that notoriously has all these possibilities because it can provide new outputs of good quality, as well as fitting in the context.

- Pre-trained Model Advantages: Generative AI is the result of education through training on huge data, thus it is coming "pre-educated" on the subject. The accounting firms don't create systems from scratch; instead, they use models that already have a good grasp of accounting principles, financial jargon, and legal requirements, and then they adjust them to their specific needs.

Critical Applications

Generative AI for accounting systems revolutionizes three main aspects: Real-time data processing allows for monitoring of transactions and flagging of irregularities automatically, as these things happen. Financial reports are automated and generated in a way that the financial story is created, not just the numbers compiled.

Predictive analytics is the tool of the future that can tell when the cash flow will get tight, when the revenues will rise or fall, and what the risks are that could cause these problems, thus converting accounting from a historical record-keeping for just reporting purposes into strategic planning.

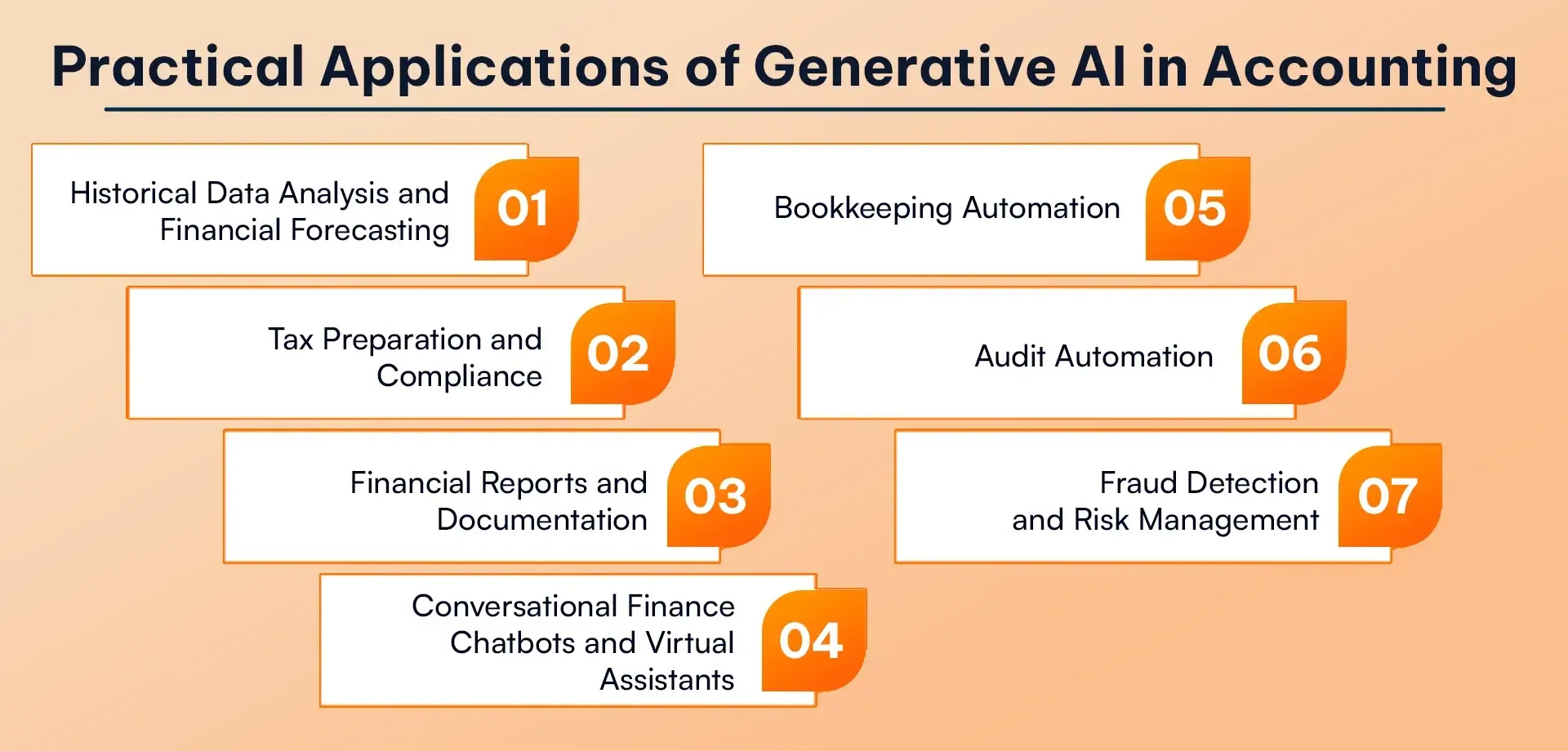

Best Applications of Generative AI in Accounting

Generative AI assists accountants by generating reports, condensing financial data, and quickly detecting errors, all performed in an automatic manner.

1. Historical Data Analysis and Financial Forecasting

Generative AI accounting summarizes financial data for years to pull out insights that can be acted upon and thus lead to strategic decision-making. The model evaluates a multitude of factors at the same time, looking into seasonal fluctuations, economic signals, consumer habits, and market movements, and it can point out the similarities and patterns that are usually unnoticed by human experts even after rigorous analysis.

2. Tax Preparation and Compliance

Tax compliance is an accounting area that has the most intricate and high-stakes dealings. Generative AI for accounting takes care of transaction processing throughout the year, effortlessly classifying them in alignment with the latest regulations.

3. Financial Reports and Documentation

The month-end and quarter-end reporting process is made easier, and at the same time, the quality of reports is improved due to generative AI usage. It not only arranges revenue and cost data but also gives reasons in writing for the major differences.

It maintains the balance sheet all the time, reflects every transaction that comes through the systems, marks major changes, and generates detailed footnote disclosures according to the data about transactions and accounting policies.

4. Conversational Finance - Chatbots and Virtual Assistants

Generative AI accounting chatbots are a game-changer for communication between departments and stakeholders. Such advanced assistants comprehend the situation and give comprehensive, precise replies. Customers can get 24/7 instant replies to their questions regarding account status, invoice information, or payment history.

These robots are different from the usual chatbots that are unable to interact naturally, as they can feel the context of the whole conversation, carry on with the multi-turn dialogue, and give answers that consider certain circumstances.

5. Bookkeeping Automation

Daily accounting functions evolve from drains of time to automated workflows. AI-based technology extracts data from bills and receipts with great precision, comprehending the context in a way that surpasses mere text conversion.

It simultaneously pairs bills with purchase orders, detects discrepancies, and sends exception cases for approval. Month-end reconciliations that previously required several days are now done in a few minutes, as the software is already matching transactions, pointing out the unreconciled items, and providing possible matches.

6. Audit Automation

Contemporary audits come with enormous amounts of data. The application of Generative AI in accounting brings the complete audit process to the ground and saves time and money as well. It not only resorts to sampling because it reviews the whole set of data and, at the same time, but also gives more confidence in the results and pinpoints problems that may go unnoticed by standard sampling methods.

The software recognizes irregularities such as double payments, dubious dates, etc., and even new types of anomalies that are not being directly programmed in the first place.

7. Fraud Detection and Risk Management

Every year, financial fraud results in losses amounting to billions of dollars. Generative AI in the financial and accounting sectors alone gives rise to real-time fraud detection and advanced pattern recognition.

It first sets up what is the expected activity by taking into consideration various factors, and then it very quickly identifies any variation, evaluating risk as well.

Also Read: Generative AI in Marketing: Tools, Benefits, and Use Cases

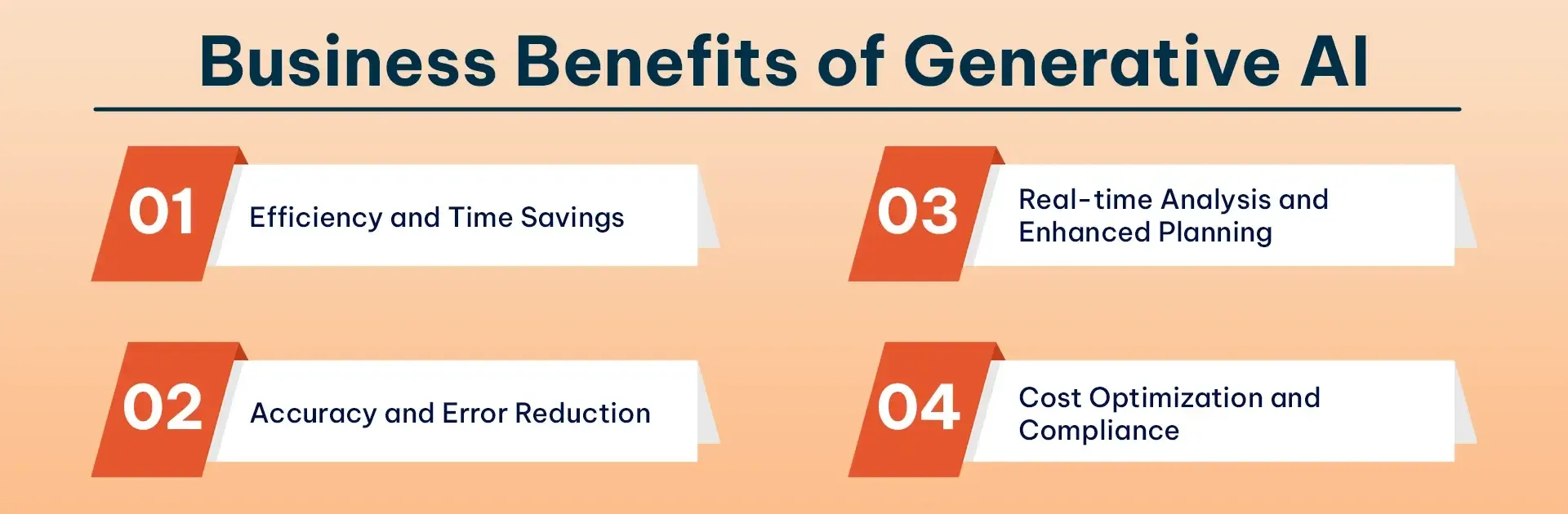

Business Benefits of Generative AI

Some of the key advantages of generative AI in finance and accounting are that they perform tasks and produce content in a fast way. Moreover, it provides better decision-making, higher customer satisfaction, and overall efficiency, which in turn gives businesses a competitive advantage.

1. Efficiency and Time Savings

ACCA has conducted in-depth surveys and noted that the companies adopting AI-based accounting solutions have gained 78% more operational flexibility. This is not merely a slight enhancement; it is a complete transformation of the system.

It is customary for accountants to dedicate 40-50% of their time to monotonous and repetitive assignments like data input, invoice matching, basic reconciliations, and report formatting.

2. Accuracy and Error Reduction

There is no doubt that human mistakes in accounting can have dire consequences, such as financial statements being misrepresented, having to deal with regulatory compliance violations, and even making poor business decisions based on wrong data.

The introduction of generative AI to the accounting industry has greatly minimized these risks by executing tasks with the same level of precision all the time, no matter how many or how complex the transactions are.

3. Real-time Analysis and Enhanced Planning

The traditional method of accounting is based on a monthly cycle. On the other hand, Generative AI used in finance and accounting has made it possible to have continuous financial visibility and instant insights. With that, managers can get direct access to current positions, which speeds up decision-making.

4. Cost Optimization and Compliance

Through routine task automation, firms are able to achieve more with their current workforce. Generative AI recognizes the areas where the company can merge its activities and negotiate for more favorable conditions by examining the spending patterns.

Implementation Challenges and Solutions

Using generative AI in finance and accounting comes with challenges such as data quality issues, system integration complexity, and skill gaps within teams. Something addressed uses strong data governance, phased implementation, and continuous employee training.

- Common Challenges: Legacy systems pose major integration challenges which can't be overlooked. Numerous accounting companies continue to use accounting systems built in the 80s and 90s that were not made to accommodate AI integration.

Workforce opposition arises mainly due to the reasonable fear of losing their jobs and the simple fact that they feel comfortable with the ways of working that have been working for them for years.

Bad data management stemming from systems that are not well integrated leads to AI producing results that are not reliable, and this affects the trust in AI. Privacy and security issues must be handled with great care since this involves highly sensitive financial information.

- Overcoming Strategies: PrivateGPT, for instance, is one of the modern cloud-based solutions that do away with most of the infrastructure-related issues and at the same time strictly control the data privacy.

By starting with carefully selected small-scale pilot projects such as invoice processing or bank reconciliation, especially, the organizations will be able to get experience, provide the stakeholders with tangible value, and gain the confidence of the organization before moving to the big part.

The quality of the data and its security issues are both effectively dealt with by establishing strong data governance frameworks with clearly defined ownership and security protocols that are comprehensive, such as encryption and access controls.

Potential Risks and Ethical Considerations

Systems of AI are capable of making errors and transmitting biases contained in their training data. A lot of them function as "black boxes," which presents a problem when the need for auditability arises.

Companies may become too dependent on such systems, and as a result, they may not have the skills to spot the mistakes.

The risk of data being intercepted necessitates encryption for both storage and transmission, in addition to conducting frequent security audits.

Real-world Case Study: Banking Transaction Automation

Even though a mid-sized regional bank had four full-time accountants working just for daily reconciliation, mistakes still happened. Reconciliations took three days during busy times, which means the reporting got delayed.

Results: The savings in time were really significant daily reconciliations that took up to 8 hours were now done in a few minutes. The time for the month-end closing was cut down from three days to just one. There was a significant decline in mistakes by 94%.

MIT Study Insights

The research carried out by MIT leans on quantitative evidence to demonstrate how generative AI has already changed the way professionals work. The use of AI by accountants led to an 8.5% time reduction on routine work, and the salvaged time was directed to activities with more value. The financial reports included an analysis that was 12% more detailed.

As a result, the duration of monthly closing cycles was shortened by 7.5 days. The expert accountants were very resourceful in their AI usage; they produced drafts and later refined them, worked on the results while interpreting them.

Best Practices and Future Outlook

The most beneficial approach with Generative AI in finance and accounting is to use it responsibly, verify its outputs, and mix it with human judgment. It will be a little bit smarter, more dependable, and will be a common tool in the future, thus assisting companies in the areas of speed, quality of decisions made, and the like.

-

Implementation Best Practice

Commence with unambiguous assignments like invoice processing. Give priority to the quality of data over the implementation of AI. Keep human supervision through routine evaluations and well-defined escalatory mechanisms. Opt for models that are clear and give reasons for their outcomes. Monitor the rates of accuracy, time savings, and errors.

-

Future Trends

In five years, the process of data entry will be automated to a large extent. In a decade, AI may take care of the majority of routine reports, leaving accountants with the roles of making decisions and planning their strategies. The profession of accounting is changing from processing transactions to imparting insights, which in turn requires the possession of more robust analytical skills, the attainment of greater business knowledge, and even more proficient communication skills.

Conclusion

The introduction of generative AI for accounting signifies a major shift that fundamentally changes the whole process and the results obtained. The evidence seems to be very favorable: ACCA surveys report 78% improved flexibility and 72% better compliance; MIT studies indicate productivity increases; and the cases of companies in practice show them going from hours to minutes in reconciling the books.

In real-world cases, platforms like RejoiceHub demonstrate how companies have reduced book reconciliation from hours to just minutes.

Frequently Asked Questions

1. Can generative AI accounting reduce errors in financial reports?

Yes, generative AI accounting minimizes human errors by processing transactions consistently and accurately, reducing mistakes in reports, reconciliations, and compliance documentation significantly.

2. What are the main benefits of using generative AI in finance and accounting?

Generative AI in finance and accounting saves time, improves accuracy, enables real-time analysis, reduces costs, enhances compliance, and allows accountants to focus on strategic tasks.

3. How does generative AI help with tax compliance?

Generative AI for accounting automatically classifies transactions according to current tax regulations, identifies deductions, prepares documents, and ensures compliance throughout the year without manual effort.

4. Is generative AI accounting suitable for small businesses?

Absolutely. Generative AI accounting helps small businesses automate invoicing, bookkeeping, and tax preparation, saving time and money without needing large accounting teams or expensive software.

5. Can generative AI in accounting detect fraud?

Yes, generative AI in accounting monitors transactions in real-time, recognizes unusual patterns, compares activity against expected behavior, and flags potential fraud instantly for investigation.

6. What is generative AI in accounting?

Generative AI in accounting uses advanced AI models to automate tasks like bookkeeping, report generation, fraud detection, and financial forecasting with minimal human input.

7. How does generative AI for accounting differ from traditional automation?

Traditional automation handles repetitive tasks, while generative AI for accounting creates content, analyzes patterns, provides insights, and adapts to complex financial scenarios automatically.

8. How accurate is generative AI for financial forecasting?

Generative AI for accounting analyzes historical data, market trends, and economic indicators simultaneously to generate highly accurate forecasts that help businesses plan budgets and strategies effectively.

9. Do accountants need coding skills to use generative AI tools?

No coding skills required. Modern generative AI accounting platforms feature user-friendly interfaces that accountants can use immediately without technical backgrounds or programming knowledge.

10. What tasks can generative AI automate in accounting departments?

Generative AI accounting automates data entry, invoice processing, bank reconciliations, financial reporting, audit reviews, tax preparation, customer queries, and expense categorization efficiently.