How about you checking your bank balance, getting investment advice and applying for a loan without human help? Yes, this is possible. This is done by artificial intelligence in finance.

The financial world is transformed by AI. It is making processes faster, smarter and more secure. But how does it work exactly? To get answers to all your questions, let us go through this blog and understand AI in finance and explore its impact.

Quick Summary

In this blog, we will learn and understand how finance AI is changing the industry. Along with that we will know about its benefits, use cases, key stakeholders and trends of the future. Keep reading further.

What is AI in Finance?

The use of machine learning, natural language processing and automation in financial services falls under artificial intelligence. This is to improve financial processes. It helps in analyzing massive data sets and making predictions. It even helps in automating repetitive tasks. It mproves efficiency and accuracy.

How is AI used in Finance?

- Financial institutions use AI for various functions. That includes:

- Fraud detection

- Customer service automation

- Risk assessment

- Credit scoring

- Investment management

- Regulatory compliance

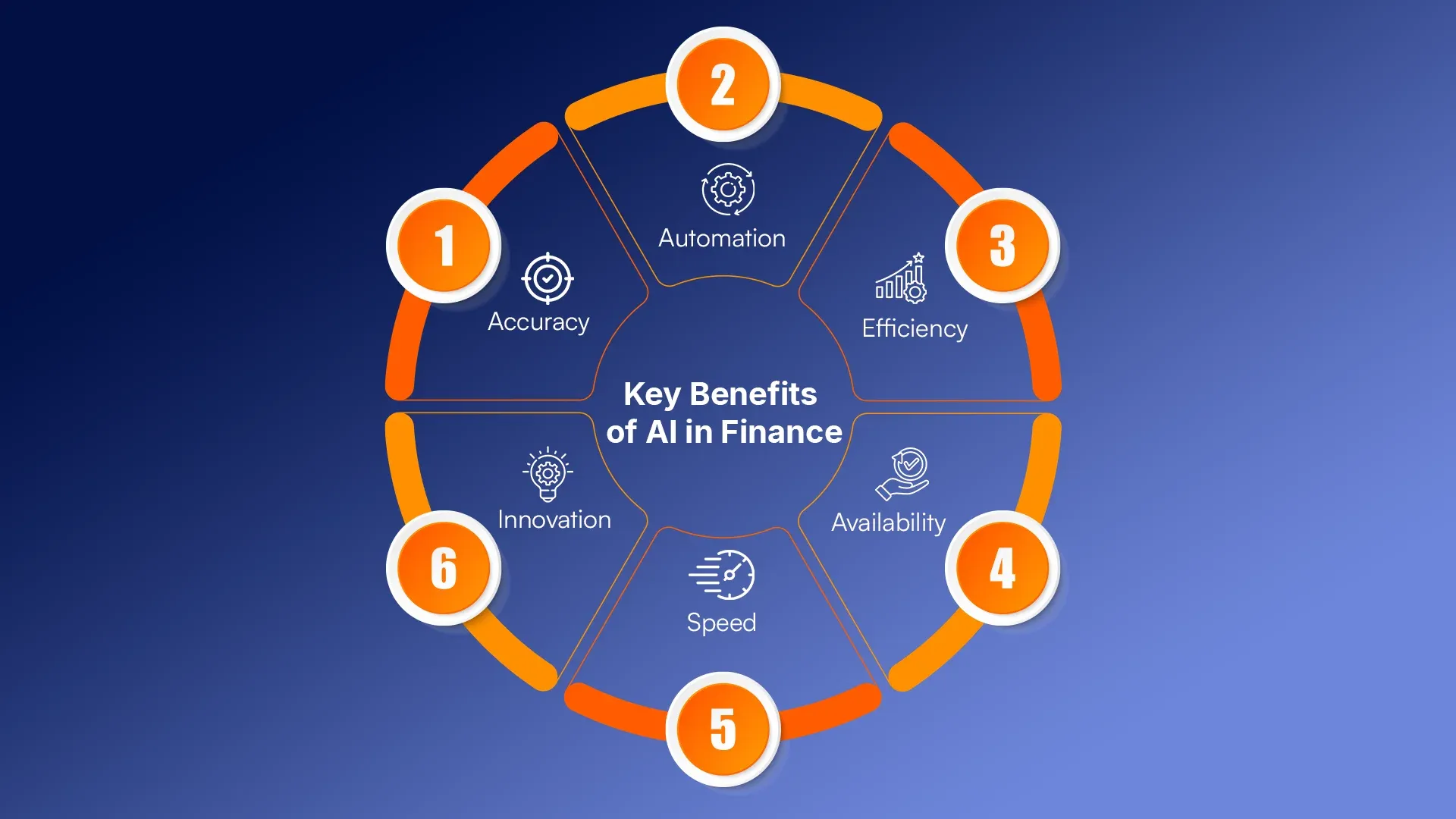

Key benefits of AI in Finance

AI brings numerous advantages to the financial sector. Those advantages are:

1. Accuracy

AI reduces human errors in financial calculations and transactions. It ensures more precise results. It minimizes risks and increases trust in financial systems.

2. Automation

Repetitive tasks like data entry and compliance checks are handled by AI. It boosts productivity and reduces operational costs. It decreases human work so that they can do other important work.

3. Efficiency

AI makes financial operations smoother and faster. This is done by simplifying processes and reducing manual efforts. It allows quicker completion of tasks and better resource management.

4. Availability

AI-based chatbots and virtual assistants deliver 24/7 customer service. It ensures help is always available by improving customer satisfaction. It even enhances user experience.

5. Speed

AI processes vast amounts of data quickly by improving decision making. It enables timely responses to the changes of the market and opportunities.

6. Innovation

AI allows new financial products and services such as robo-advisors and AI-based trading algorithms. It even fosters financial innovation and competitive advantages.

Also Read: How Artificial Intelligence is Transforming Businesses in 2025

How can AI solve real challenges in Financial Services

AI helps in addressing key challenges in finance, it offers advanced capabilities like:

1. Anomaly Detection

It identifies fraudulent transactions in real-time. This is done by safeguarding assets and preventing financial losses. It makes sure that financial operations are secure and trustworthy.

2.Speech Recognition

It improves voice-based banking and customer interactions. This makes it easier for users to access and even manage their account hands-free.

3. Translation

AI makes services accessible globally by translating financial documents and communications. This is done by breaking language barriers and expanding market reach effortlessly.

4. Sentiment Analysis

It understands market trends by analyzing customer feedback and social media. It helps institutions in predicting shifts in customer sentiment and market conditions.

5. Image Recognition

Artificial Intelligence verifies identity through facial recognition. It enhances security measures and simplifies the verification process. It even reduces the risk of identity fraud.

6. Data Science and Analytics

It extracts valuable insights from financial data by enabling data-based decision-making and personalized financial service. This boosts overall operational efficiency.

7. Generative AI

AI automates financial reports and summaries. This saved time and resources. It even makes sure that financial documentation and insights are accurate and consistent.

8. Predictive Modeling

It forecasts market trends and investment opportunities. This helps financial institutions in making informed decisions and using investment strategies for better returns.

9. Cybersecurity

AI detects and prevents cyber threats. Along with that it protects financial information that is sensitive and maintains the security of financial systems and data.

10. Conversations

It improves customer experience with AI chatbots. This is done by providing instant, personalized assistance and resolving queries quickly. It enhanced customer satisfaction.

11. Document Processing

AI automates loan applications and compliance checks. It accelerates the approval process by ensuring regulatory compliance and reducing manual workload.

Key Stakeholder of AI in Finance

There are various players involved in the AI-based financial ecosystem. Those are:

1. Customers

They benefit from faster and more personalized financial services. This results in gaining access to tailored solutions, better customer experiences and improved financial management tools.

2. Auditors and Internal Control Teams

AI is used for compliance and fraud detection. It improves accuracy and reduces manual effort. This ensures observance of regulatory requirements with better efficiency.

3. Chief Information Offers (CIOs) and Chief Technology Officers (CTOs)

They drive AI for adoption within organizations by overseeing technology strategies. This ensures seamless implementation and enables digital transformation for competitive advantage.

4. Legal Teams

They ensure AI-based financial applications and solutions comply with laws and regulations. This led to addressing legal risks and maintaining ethical standards in AI deployment.

5. Risk Management Teams

AI is used for fraud prevention and risk assessment. It identifies potential threats by improving security measures and mitigating financial risks with advanced predictive capabilities.

6. Executives

They make strategic decisions based on AI-generated insights by using data-driven intelligence to guide business strategies, improving performance and achieving organizational goals.

Also Read:Top 15 Applications of Artificial Intelligence in Business

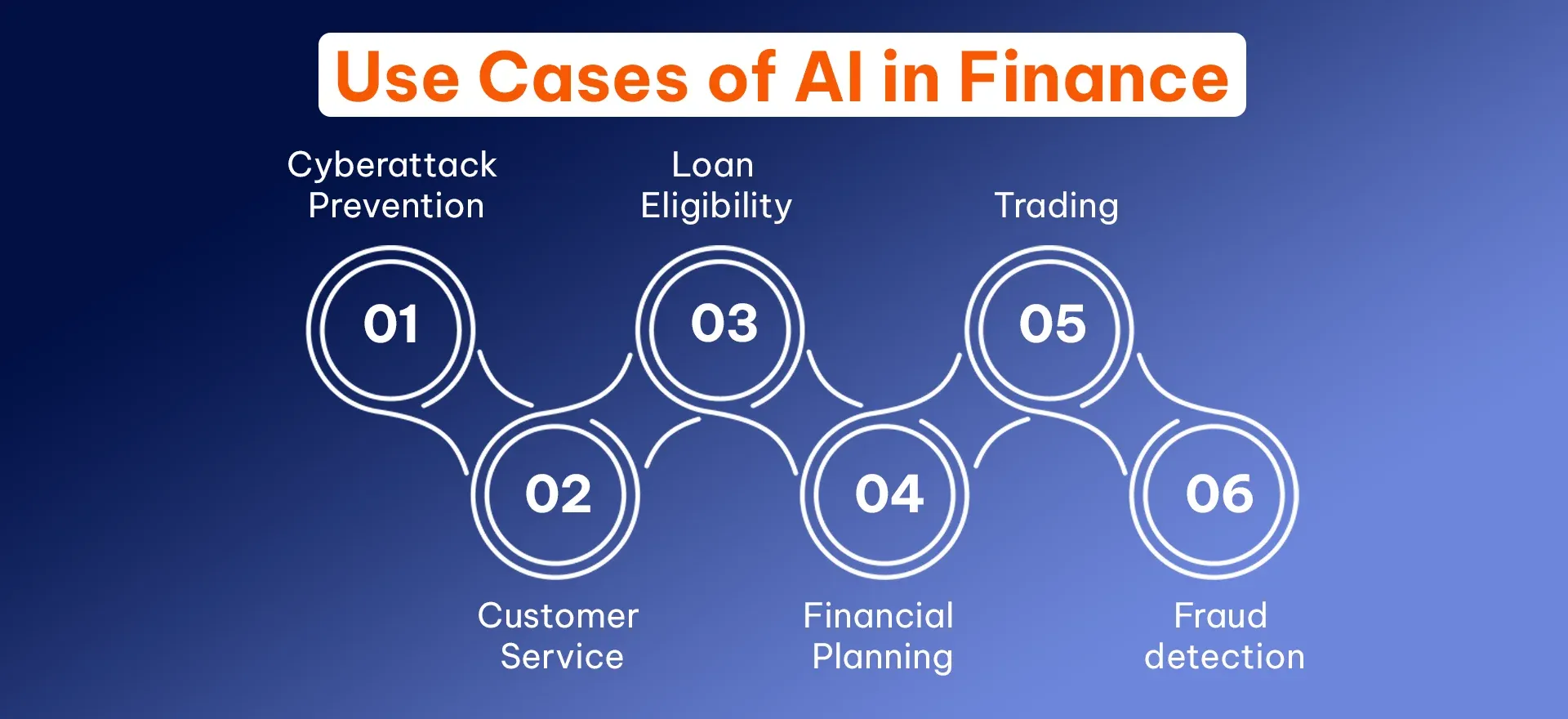

Use Cases of AI in Finance

AI is transforming finance with various applications. Those include:

1. Cyber Attack Prevention

It detects and mitigates cybersecurity threats. It protects sensitive financial data and prevents breaches. This ensures security and maintains the integrity of financial systems.

2. Customer Service

AI-based chatbots handle queries efficiently. It provides instant responses, resolves issues promptly, enhances customer satisfaction and reduces the workload on human customer service agents.

3. Loan Eligibility

AI analyzes credit scores and financial history for loan approvals. It simplifies the approval process and reduces biases. It even makes sure that financial resources are fair and quickly accessible.

4. Financial Planning

Robo-advisors give tailored advice for investment. It creates tailored financial plans and manages portfolios. This offers cost-effective solutions and helps individuals achieve their financial goals.

5. Trading

AI algorithms predict market trends and use trading strategies. It optimizes trades, maximizes returns and minimizes risks. It ensures quick and accurate execution of trading decisions.

6. Fraud Detection

It identifies suspicious activities in real-time. This prevents fraudulent transactions and protects assets. It even enhances trust and ensures the safety of financial transactions and operations.

The Future of AI in Financial Services

The future of AI in finance seems promising. AI will be used by financial institutions. It will be for more sophisticated decision-making with advancements in machine learning and deep learning. AI-based blockchain solutions, AI-based investment platforms and hyper-personalized banking experience will shape the future of financial services.

Conclusion

Partnering with experts like RejoiceHub LLP an bring change for businesses seeking to integrate AI-based solutions into their financial operations. RejoiceHub LLP specializes in AI development services. These services offer customized solutions for organizations to make use of the full capability of AI in financial services.

Frequently Asked Questions

How does AI improve fraud detection in finance?

AI spots and stops unusual transactions in real time by keeping your money safe.

Can AI help with financial planning?

Yes, AI based robo-advisors provide personalized investments and financial planning advice.

Is AI safe for banking and finance?

Yes, it helps in protecting your money by detecting and stopping fraud quickly. It keeps your financial information secure.

Does AI help in managing money in a better way?

AI can give personalized advice on saving, investing and budgeting.