When was the last time you paid a bill online, booked a movie ticket, or used UPI, a credit card, or net banking?

I can confidently say that you must be using these services regularly, but you might not know that behind this powerful and smooth payment system, very complex AI algorithms are used to maintain security and a smooth experience in digital payments.

I have personally used many AI-driven payment gateways and tools, and on that basis, I can say that maintaining a real-time payment gateway is very difficult because the chances of fraud in it are very high. AI systems try to fix all these security parameters to a great extent.

There is no doubt that AI has revolutionised the landscape of digital payments today. What required a manual process to approve and often a couple of days or multiple levels of approvals now takes seconds and is entirely due to intelligent automation.

Whether you are working in banking, e-commerce, fintech, SaaS, retail, or the subscription economy, AI is no longer a tool you leverage; it is the central nervous system that drives secure, fast, and personalised payments. In this article, I will guide you about AI in payments based on real industry experience.

Quick Summary

Payment applications of AI comprise technologies such as machine learning, natural language processing, deep learning, predictive analytics, and automation to facilitate the optimization of the financial transaction process. There are more than 640 million UPI transactions and 674 million Visa transactions on a daily basis in India; this tells us a lot about the value of digital payments.

Specifically, AI is suited for identifying and investigating suspected fraudulent transactions, automating risk decisions, optimising internal processes, delivering customer experiences, personalising products and services, and improving decision accuracy.

Nonetheless, AI technology poses challenges such as algorithmic bias, privacy and data issues, complexity of integration, compliance and regulatory issues, and cost of implementation.

Our focus in this article:

1. What is AI in payment systems, and how does it work?

2. Which AI technologies are being used in payment systems?

3. Why is it important to use AI in digital payment systems?

4. What are the future trends of AI in digital payments?

5. What has been my personal experience using AI-driven digital payments? We will also discuss this.

What is AI in Payments?

AI in payment systems means smart technologies that can think, learn and make decisions like a human, just faster and better. AI doesn't take the route of other, traditional rule-based systems that strictly follow instructions, but instead, it learns from previous transactions, identifies patterns, detects anomalies, and predicts outcomes. In simple terms, let's know what AI does to help make digital payments smarter, safer and more personalised. AI analyses tremendous amounts of data:

- Transaction history

- Device behavior

- Merchant type

- Geolocation

- Spending patterns

- Customer profile

All this data together allows AI systems to determine whether a transaction is authentic or fraudulent in a matter of milliseconds.

Key Technologies Behind AI in Payments

Major AI components involved in digital payments include:

| Technology | Function |

|---|---|

| Machine Learning | Fraud detection, credit scoring |

| Natural Language Processing (NLP) | Chatbots, voice payments |

| Predictive Analytics | Risk & liquidity forecasting |

| Neural Networks | Dynamic decisioning |

| Computer Vision | Automated document verification |

| Generative AI | Personalized experiences |

These technologies enable financial institutions, payment service providers (PSPs), fintech companies, and e-commerce businesses to assess millions of digital signals instantly and make automated decisions.

Why is AI Important in Payment Today?

It is not possible to regulate real-time payments through manual banking operations, and the chances of breach in real-time payments are very high; hence, AI systems are used in them to make the payment gateway smart and automatic and in such a situation, if any fraudulent activities take place, the AI systems automatically block them.

Traditional payments operated: If this matches the rule, it will approve; otherwise decline. However, criminals got smarter, and payments needed smarter intelligence. AI can evaluate thousands of behavioural and contextual variables, not just rules. This is what helps with much more accuracy in the decision.

Example:

If a person regularly spends money in London and suddenly creates a high-value transaction request in Japan, previous systems would have declined it right away.

AI would look into:

- Device fingerprint

- Travel history

- User behavior

- Merchant category

- Past transactions

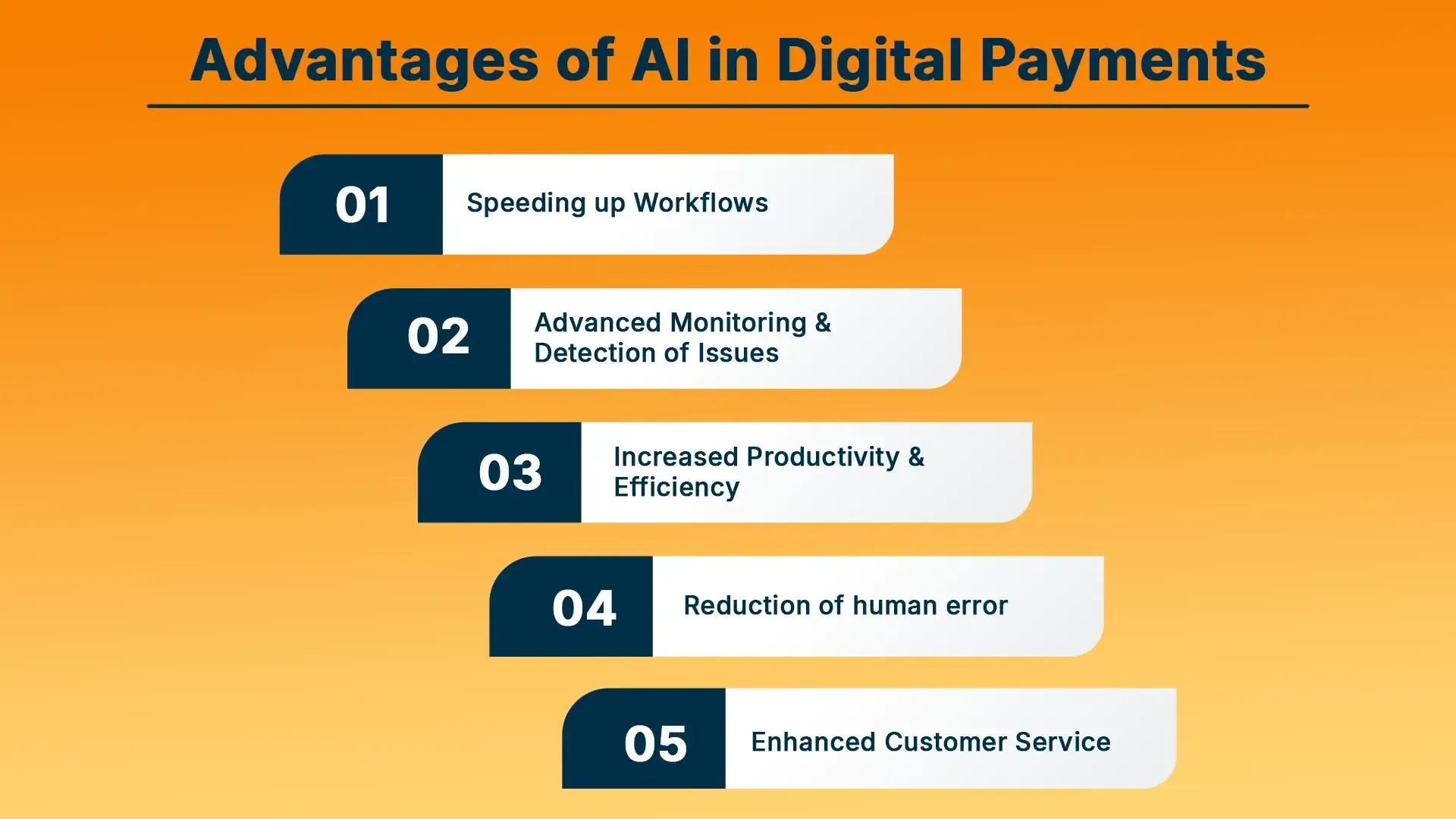

Advantages of AI in Digital Payments

AI systems are used to make digital payments safer and secure, and digital payments make transactions smoother and also reduce corruption significantly. Let us understand the core advantages of these digital payments in detail.

1. Speeding up Workflows

The processing speed of digital payments matters a lot because if the speed is slow, then the ratio of payment decline and failed transactions will increase significantly, which is not good for digital payment systems.

Processing & automation in real-time: AI can automate manual tasks, such as data entry, invoice processing, reconciliation, routing, and approvals. Manual processes that took hours/days now only take seconds.

In summation, there is a much quicker, non-frictional customer journey while relieving some operational burden as well.

Scalable payment system: During busy seasons, transaction volume surges.

AI can predict load and help scale infrastructure, avoiding downtime and helping to provide a more seamless payment experience.

2. Advanced Monitoring & Detection of Issues

As we all know that digital payments happen on real real-time basis, hence proper monitoring is very important to avoid fraudulent activities.

Real-time anomaly detection: AI processes every transaction in real time to look for anomalies in behaviour. AI learns from historic fraud attempts and can adapt to new behaviour, which creates a robust cybersecurity defence.

Reference systems are always monitoring datasets of large datasets to find anomalies.

Predicting issues before they impact customers: AI systems are able to identify technical issues, failed routing, gateways down, and more, prior to impacting customers.

This helps to avoid delayed transactions and provides more confidence in reliability.

3. Increased Productivity & Efficiency

Digital payments are a very time-saving method of payment in daily life, and they significantly increase efficiency and productivity.

(1) Less manual burden: Digital payments lead to automation and make the system more efficient, thereby significantly reducing the manual burden on the human workforce, as the systems automate most of the repetitive tasks, e.g.

- Data entry

- KYC scanning

- Fraud screening

- Compliance programs

- Account reconciliation

This allows employees to prioritise strategy over administrative tasks.

(2) Improved quality of decisions: Due to AI in digital payments, predictive analytics systems are very high, which helps them a lot; this improves financial services further, and decision-making becomes more effective.

- Customer value

- Risk areas

- Revenue leakages

- Credit intent

This creates more intelligent, profitable decisions.

4. Reduction of human error

Automated digital payments significantly reduce manual errors because AI systems streamline fraudulent activities and processes. This is why AI systems are used in digital payments to avoid errors.

- Automated validations give an upright level of accuracy: When human teams are involved in approvals, KYC entries, or invoice matches, there is an opportunity for error, despite being reasonable.

Machine logic based on data doesn't allow for error.

- High compliance accuracy: AI reads and validates documents, reducing mismatches, and verifies identities securely at scale.

5. Enhanced Customer Service

You must have seen AI chatbots many times in digital payments. This benefits Fintech companies even more because it provides 24/7 customer support to the customers.

(1) Individualised help: With behavioural analytics, the platform will be able to anticipate what its users want most, whether it's home loan terms or subscription services, enhancing satisfaction and increasing engagement.

(2) Chatbots are available 27/7: AI chatbots can answer frequently asked questions immediately, reducing response times and support costs.

Major Areas of Impact Where AI is Influencing Digital Payment

An AI-driven payment system is no longer simply a feature; it's becoming the centre of the digital payment evolution. AI is enhancing security, customer experience, and operational efficiency, enabling financial institutions and businesses to stay ahead of the competition. Below, we have identified the key areas where AI is having the greatest impact

1. Personalisation & Customer Experience

AI understands preferences, spend categories, payment modes like UPI, card, wallet, favourite merchants, etc. Based on this data, AI recommends the best payment method for each customer.

For example, if a customer is used to paying via a digital wallet, the system highlights the wallet option first during the adoption stage. This reduces friction and increases conversion.

AI will learn about spending behaviours and recommend relevant, specific offers to customers, such as monthly EMI offers, cashback or seasonal discounts. This level of personalisation increases customer engagement on the platform and builds loyalty.

2. Fraud Detection & Prevention

Real-time data-informed threat detection; AI looks at massive amounts of transaction data, in milliseconds, for abnormal patterns or behaviours that include:

- Device ID

- Location

- Frequency of Transactions

- Buyer Behavior

These identifiers are used to enhance the accuracy of spotting suspicious activity and can save you money.

Unlike traditional payment rules engines, AI approaches every unique data point as a potential place for learning. Therefore, as the tactics of fraud shift and evolve, the machine learning models will learn automatically to detect new threats, reducing the chances of a transaction being fraudulent. The dynamic aspect makes AI better than a legacy fraud and transaction detection service.

3. Risk Management & Credit Scoring

Due to AI, the paperless loan-giving process has become much smoother, and it can manage the risk to a great extent. Due to the AI system, 70% faster credit decisions have become possible in the paperless loan process, which is an important part of the loan-giving process.

(1) Intelligent credit assessment: Credit checks with traditional banking rely on minimal financial history, while AI analyses a broader view, including:

- Transaction Behavior

- Monthly Bill Payments

- Shopping Patterns

- Business Stability

- Cashflow History

This smarter approach leads to a more accurate risk score than one person looking at the financial information.

(2) Quicker lending decisions: AI drives the ability to approve real-time credit. Therefore, banks and fintechs can now approve loans much faster, confidently, even when new to credit, with no formal credit score history.

Financial institutions also use neural networks to improve risk assessment and evaluation of someone's credit risk.

4. Processes for Automated KYC

For payment gateways, KYC registration and payment behaviour analysis play a very important role, and AI systems are quite useful in this regard for real-time payments.

(1) Intelligent extraction of documents: The AI functions of computer vision and Optical Character Recognition (OCR) read documents, including:

- ID/IDs

- Passports

- Utility Bill

- Business License

- Invoices

AI extracts relevant information independently and/or prevents the member from having to copy and manually enter information.

(2) Onboarding quicker and compliance: AI compares the document information against government/financial institutions' database information on identity verification.

This expedites customer onboarding and compliance with regulated items such as Anti-Money Laundering (AML), Counter-Financing Terrorism (CFT).

This reduces fraud risks and enhances user experience.

5. Cross-Border Payments

Intelligent Routing for Global Transactions: AI will analyse exchange rates, compliance regulations for transaction fees, and time of processing, to determine the cheapest route for payment to take place internationally.

This provides:

- Lower Cost

- Faster Transfers

- Higher Success Rate

Real-time language + compliance support: NLP aids in translating documents, messages, and customer inquiries in real-time, eradicating any language obstacles.

NLP also assesses regional regulatory requirements prior to processing.

As a result, AI enhances the ease of global money transmission.

6. AI in IVR Payments

According to recent developments, AI systems are being used extensively for IVR payments, which provides more safety and smoothness to the payment system.

(1) Automated conversational payments: AI enhances IVR systems to assess a caller's intent and can divert them to the right payment function, such as bill pay, loan EMIs, or card payment. This improves the customer experience by reducing waiting time.

(2) Smart escalation to agents: In the case that the system determines that the case is complex, its programmed procedure is to transition the caller to a human agent who has gained context from the previous interactions with the system. This hybrid design model increases efficiency while still maintaining an element of humanity.

My Experience with the World's Two AI-Driven Payment Systems

In the last ten years, using digital payments has become a normal part of the way I live. I did not choose to do that; as technology advanced, I advanced with it. The biggest influencers in my life have been two payment systems: UPI in India and Visa for international transactions. My experiences with both have been very different and very impactful.

-

UPI (My Daily Companion Since 2016)

I started using UPI (Unified Payments Interface) in 2016, at the dawn of digital payments in India. Back then, I was still doing most of my transactions in cash until UPI came along. I slowly started trusting UPI, first for little payments, a cup of tea, grocery bills, medicines at the local shop; everything was now just a few taps away. Today, I can say that it's my default way of making payments.

I was early to adopt UPI, and what amazed me was how quick and easy it was. I recall at one point being impressed that I didn't even have to enter any bank details anymore. All I needed was either a phone number, a UPI ID, or a QR code, and boom, the money was sent in seconds.

Over the years, UPI has become cleverer, with things like automated reminders (AI-assisted), automated bill payments, and AI-assisted fraud detection. All these enhancements have made a range of everyday tasks effortless for me now.

Best Part:

It is easily accepted by everyone, from street vendors to an online platform. There is no minimum amount, and it is extremely easy. Sometimes when I travel, I almost never carry cash. UPI provides me with confidence and ease of use that I never had before.

-

Visa (My Gateway to Global Transactions Since 2014)

My experience in digital payments actually began earlier with Visa in 2014.

When I first received a Visa card, it felt luxurious and modern, and it was something that gave me access to a global platform. The online shopping revolution in India was just starting up. I mainly used Visa for online purchases, travel, electronics, subscriptions, etc. The first thing I noticed is that Visa felt very safe and was acknowledged universally. No matter whether I was shopping on an Indian website or an international one, Visa was accepted almost everywhere. That was very reassuring as it enabled me to shop without needing to figure out what currency worked and what the restrictions were by country.

Over time, Visa adopted AI-powered fraud alerts, one-time password verification, and real-time over-transaction monitoring. More than once, Visa sent alerts of suspicious activity and, as a result, blocked the suspect transaction. That reassurance made me trust Visa even more.

Best part:

Universal usage and strong security features. Even when paying abroad or online in another currency, I've never had any issues.

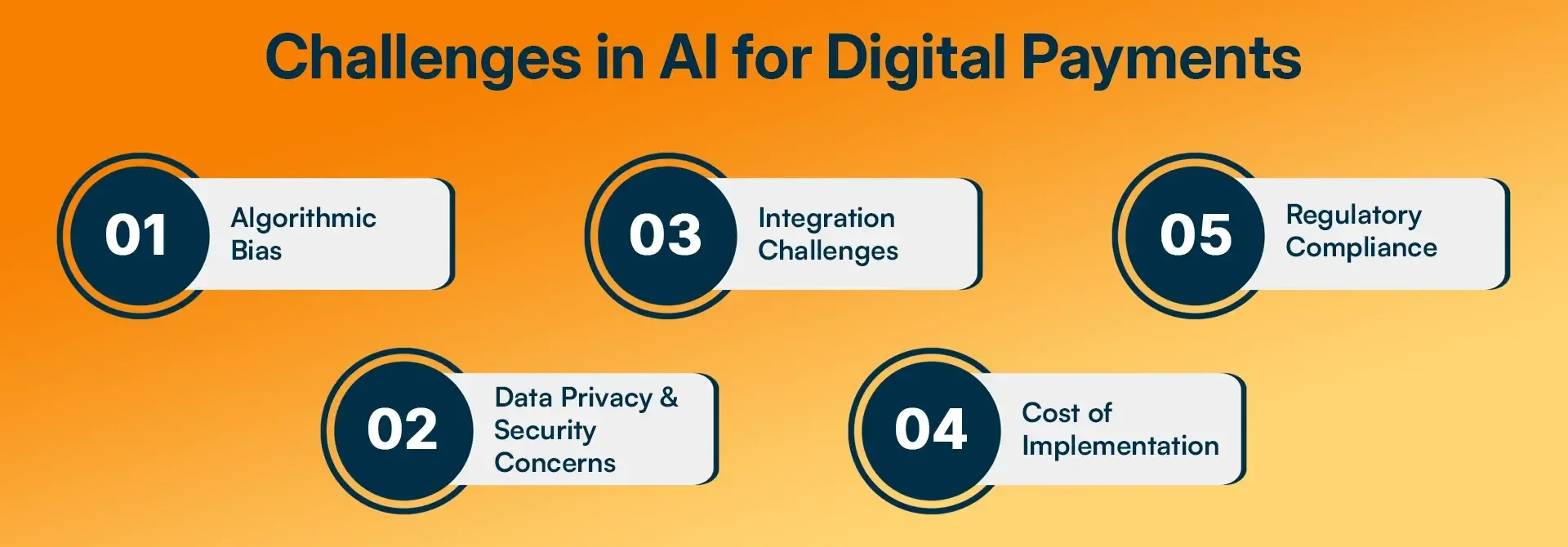

Challenges in AI for Digital Payments

Despite its substantial benefits, using AI in practice brings real-world challenges. It is important to address those challenges carefully to ensure responsible and effective use. The major challenges are summarised below:

1. Algorithmic Bias

Having biased data can lead to biased outcomes because AI models are based on datasets that are historical.

If associated historic data is biased in any form, say demographic or regional-based trends, the system may lead to unfair decisions.

This can happen in:

- Fraud detection

- Loan eligibility

- Flagging transactions

The result of this bias may be a legitimate user incorrectly identified as high risk.

Continuous Monitoring Required: Human oversight is necessary to maintain fairness in AI.

- By regularly validating and auditing models, in addition to confirming the transparency of the systems, an institution can ensure that decisions are accurately and equitably made.

- First-tier institutions will need to update training data and feedback loops to maintain fairness in the model.

2. Data Privacy & Security Concerns

Sensitive data must remain protected: AI systems rely on large datasets, which include personal and financial information.

If that data is exposed, there are immediate privacy risks.

Financial institutions must protect:

- Personal identity information

- Financial records

- Business transactions

Protection through encrypted, anonymized and secured access protocols should be established.

Compliance with global regulations: Financial institutions must follow global privacy rules, such as:

- GDPR

- CCPA

- AML/CFT

- Local data protection laws

They must ensure ethical use of data, proper consent, and transparency. Violations can lead to heavy penalties, reputational damage, and legal disputes.

3. Integration Challenges

Banking or financial institutions are using very old systems, and integrating them with the current version is not that easy and involves a lot of challenges.

Complexity with legacy systems: Most older payment systems were not designed for advanced AI., Integrating ML models requires:

- Strong data pipelines

- Standardized formats

- API integration

- Infrastructure modernization

This makes implementation more complex.

Handling structured vs unstructured data: Structured payment formats like ISO 20022 are sometimes difficult for generative AI tools to interpret directly.

Institutions must build hybrid workflows where simpler tools handle structured data, while AI focuses on decision intelligence.

4. Cost of Implementation

As we know that integration of AI into any existing system is not that easy and it requires a lot of updation to make the existing system capable of current AI models, and many small banks and Fintechs cannot afford this.

High initial setup cost: Developing and maintaining AI systems requires:

- Skilled professionals

- Advanced infrastructure

- Cloud resource usage

- Continuous training

These create significant upfront investments.

Phased adoption reduces cost: A practical strategy is starting small, e.g., AI for fraud detection, then KYC, then routing.

Cloud-based platforms lower the cost barrier because institutions don't need to build infrastructure from scratch.

5. Regulatory Compliance

AI-based payments must be done digitally, but it is important that they work as per the laws of the government and banks. For this, regulatory compliance is very important, it can monitor the payment gateways.

(1) Rapidly changing rules: AI in financial services is still evolving. Regulations are frequently updated to address security, transparency, fairness, and accountability.

Businesses must keep pace with new requirements.

(2) Documentation, audit trails & transparency: AI outcomes must be explainable. Regulators require clarity, like:

- "Why was this transaction flagged?"

- "Why was a user declined?"

Payment companies must maintain strong governance frameworks to ensure compliance and traceability.

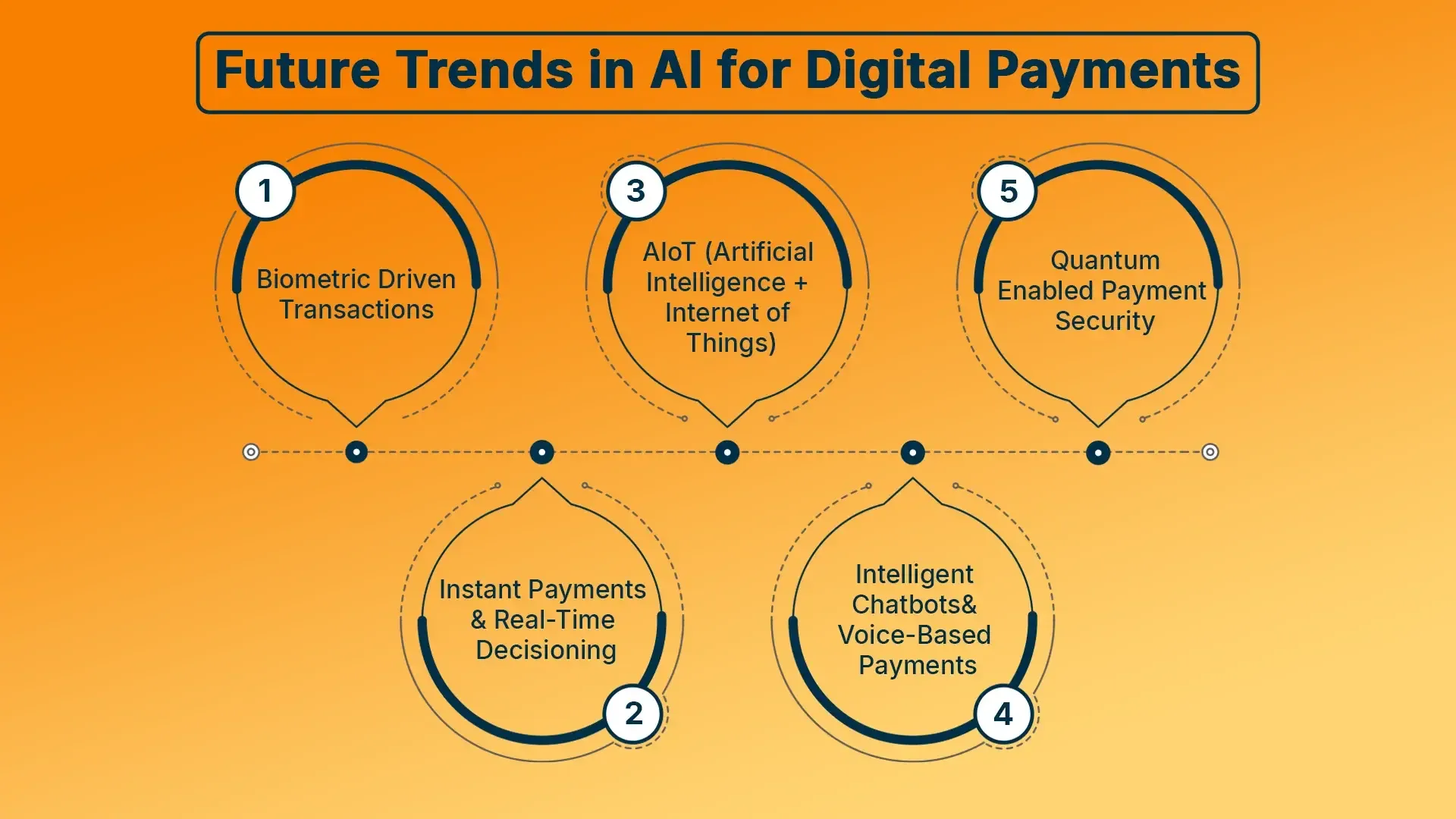

Future Trends in AI for Digital Payments

AI is about to make the digital payment ecosystem even more transformative. In the coming years, we will have more secure authentication, expedited transactions, connected smart devices, and new technologies such as quantum computing that will change speed and security altogether. Below are the big trends shaping the future of the industry.

1) Biometric-Driven Transactions

Digital payment security is swiftly transitioning to biometrics like facial recognition, fingerprint scans, and voice confirmation. As they provide a strong layer of identity assurance, credit cards, passwords, or OTPs are no longer relied upon as much.

With AI powering the biometric systems, there's far less possibility of spoof attempts, deep fakes, and synthetic IDs and only legitimate users will be authorised for payment.

2) Instant Payments & Real-Time Decisioning

Faster payment networks, such as UPI, FedNow, and PIX, will speed up transactions that span the globe.

AI will make these systems even more robust with instant risk assessments, routing optimisation, and fraud protection in milliseconds! AI can also provide liquidity needs forecasting, rate anomalies and suggest the quickest and cheapest route for the funds to move.

3) AIoT (Artificial Intelligence + Internet of Things)

AIoT offers smart devices enhanced with intelligent payment capabilities. Smart cars will automatically pay for tolls, refrigerators will automatically order groceries, and intelligent devices will facilitate purchasing in a real-time context. Payment decisions will be made on behalf of the user based on user preferences, behaviours, and the environment to create frictionless commerce.

Major Benefits:

- Hyper-convenient transactions

- Personalized recommendations

- Greater automation

4) Intelligent Chatbots & Voice-Based Payments

AI-powered chatbots will be able to do more than simply answer FAQs. They will manage more complex tasks, such as refunds, billing inquiries, credit requests, and disputes. Similarly, using voice-based payments through natural language processing will become more prevalent (via mobile assistants, for example).

Major Benefit:

- 24/7 personalised assistance

- Quicker resolutions

- Enhanced customer satisfaction uplifts

5) Quantum-Enabled Payment Security

Quantum computing will grow processing power tremendously, helping to better detect payment fraud sooner and increase encryption. The introduction of quantum cryptographic methods will keep data secure from advanced cyberattacks, primarily for companies and entities involved with global and digital currencies.

In short, by utilising AI and quantum together, quantum-based systems can provide almost instant access to global payments once a payment is authenticated and uses super-secure authentication.

Which Businesses Are Getting the Benefits of AI Payments?

Payments powered by AI are revolutionising nearly every type of industry reliant on digital transactions. For B2B enterprises, e-commerce and marketplace organisations, subscription services and Software-as-a-Service companies, AI provides businesses with secure payments while also improving operational efficiencies and profitability. The following are the industries most impacted:

1) B2B (Business-to-Business)

AI has undoubtedly improved back-office financial processes. Invoicing, reconciliations, vendor payments and transaction approvals are automated, that is, requiring less human input and reduces most possibility of human mistakes.

AI-based credit profiling can also evaluate partners or customers in real-time, in order to respond and facilitate lending opportunities and mitigate defaults.

Advantages:

- Faster settlements

- Reduced operational workload

- Accurate credit decisions

2) E-commerce

E-commerce companies are engaging in millions of transactions per day; thus, the need for AI is paramount. AI allows for an engaging personalized checkout journey by recommending optimal payment options or prospective promotions based on user preferences.

AI detection models indicate suspicious behaviours, reducing the amount of chargebacks involved with unauthorised transactions; thus, making online shopping a safer behaviour for everyone.

Benefits:

- Higher conversions

- Better fraud prevention

- Smoother checkout experience

3) Subscription-Based Businesses

Subscription-dependent revenues must have a reasonable and timely recurring payment; therefore, using AI can not only help you cycle through billing strategies but also predict potential failures and alert users with friendly reminders to ensure regular revenue flow.

AI can also analyse the overall usage behaviour of customers, to help organisations indicate which customers are at risk of churn and to allow means to proactively re-engage.

Outcomes:

- More predictable revenue

- Higher retention

- Lower churn rate

4) SaaS (Software-as-a-Service)

SaaS platforms depend on ongoing billing and customer retention. AI provides automated billing, subscription management, tax calculations and ongoing compliance.

AI chatbots assist with onboarding new users, upgrading experiences, and support troubleshooting, while increasing experience and decreasing support costs.

Results:

- Automated operations

- Better onboarding

- Stronger fraud prevention

Conclusion

AI is revolutionising digital payments across the board, from reducing fraud and credit scoring to automating onboarding and delivering a personalized experience.

My own real-world application of AI-based payment systems has shown me one thing when it comes to AI and payment: Companies that adopt AI are the market leaders of tomorrow. Today, AI is changing payer systems, even more than they previously were.

So, whether you are a start-up founder or an AI expert, I would recommend you use AI systems in the payment automation of your business process and for this, you can choose trusted firms like Rejoicehub.

B2B, SaaS, subscription, and eCommerce industries are already recognising tremendous advantages from in-systems productivity, revenue, and credit trustworthiness. Are there questions surrounding privacy, integration, or use of algorithms? Yes, but regulation of clear governance, different security controls, and particularly human checks and balances will configure those.

Frequently Asked Questions

1. What is AI in digital payments?

AI in payments refers to using technologies like machine learning, NLP, and predictive analytics to make payment processing faster, safer, smarter, and more personalized.

2. How does AI improve security in payments?

Modern AI analyses large amounts of transaction data to detect unusual behaviour. It identifies fraud patterns early, preventing unauthorised transactions.

3. Can AI reduce false declines?

Yes, AI examines behaviour and transaction context, ensuring that legitimate transactions are not mistakenly rejected. AI systems are much smarter for fraudulent activities detection and blocking, and in real-time payment, it becomes so important to include automation.

4. How does AI support KYC processes?

AI automates KYC through document scanning, verification, and cross-checking, reducing onboarding time and errors. Most KYC systems have access to government document portals, and they use this information to cross-verify user data.

5. How does AI improve cross-border payments?

AI identifies the best route, exchange rate, and compliance checks, reducing cost and increasing speed. Digital Payments also avoid corruption.

6. Is AI useful for subscription-based businesses?

Absolutely, it automates billing, predicts churn, and suggests offers for user retention. So many Saas products use AI for subscription-based business.

7. Does AI improve customer support?

Yes, AI chatbots offer 24/7 support, faster responses, and personalised help. Due to AI payment systems, many businesses grow at a rapid rate.

8. What are the main challenges of AI adoption in payments?

Key challenges include data privacy, algorithmic bias, regulatory compliance, integration complexity, and implementation cost.

9. Is AI expensive to implement?

Mostly, initial costs can be high, but cloud-based tools make phased adoption affordable for most businesses. In the long term, AI implementation gives high ROI.

10. What is the future of AI in digital payments?

The future includes biometric authentication, AIoT, advanced chatbots, quantum-secure transactions, and smarter cross-border payments. As the payment system advances, the cost of the transaction will also be less.