Let’s get in touch

Schedule a meeting with our Expert to discuss your needs and explore tailored software solutions.

Support center +91 9825 122 840

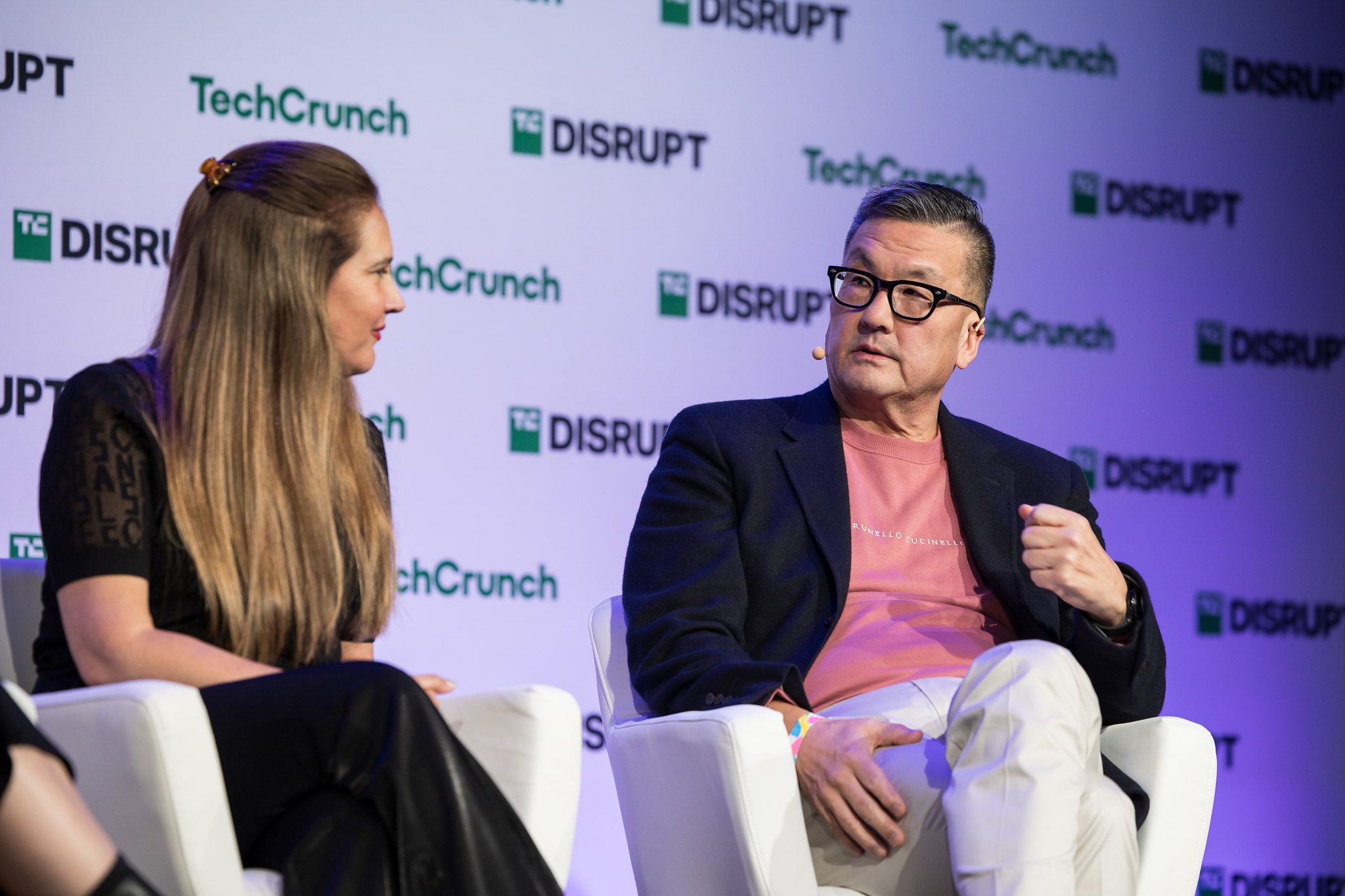

Founders should seek sector alignment when looking for a family office investor

Family offices invest a substantial amount of capital in startups each year. In the first half of 2023, 27% of overall startup deal value came from deals that included a family office investor, according to a recent report from PwC.

Despite their prevalence in startup deals, family offices can be a mysterious class of investors for founders to navigate, as they are not nearly as public or as easy to find as VCs. Multiple family office investors said during a TechCrunch Disrupt panel that the easiest way to approach investors like themselves is to seek out family offices that have alignment with what a startup is building.

Bruce Lee, the founder and CEO of Keebeck Wealth Management, said that when founders are looking to get connected with family offices, they should seek out families that made their wealth in the sector the startup is building in.

“[Family offices] have to kind of look for areas where you feel you have edge, or that the family has edge in a particular technology, so they can add strategic value to not only the conversation, but to the investment itself,” Lee said.

Eti Lazarian, a principal at Elle Family Office, agreed and added that families want to find businesses that are complementary to their own.

“When a family invests in something that has to do with the business that they are in, they can bring a lot of value to your business, as well as a collaboration,” Lazarian said. “So usually we’re looking for something that can complement each other.”

Both Lazarian and Lee added that this alignment is not only related to finding family offices, but is also one of the things that makes family offices good investors to have. Lazarian said that family offices tend to make investments into companies that they care about on an emotional level compared to traditional VCs. She added that when family offices invest, they do so to see a company succeed no matter what, which can make them more flexible and patient investors.

“When you work with venture capital, you feel like always you have a gun to your head that you have to … perform to their goals,” Lazarian said. “When you work with a family office, it feels like the runway is more extended. You have more time. It feels like you know you have more air to breathe as you’re working towards your goals.”

Both Lazarian and Lee added that for founders looking to meet family offices in their respective industries, industry or regional conferences are a great place to start because family offices frequent these events.

Once a founder gets connected with a family office, Lazarian and Lee said they should expect to pitch them differently. While startups can pitch VCs on dreams and aspirations, that doesn’t work on family offices. Companies should pitch their projections and metrics, not that they will be a future unicorn.

Work with us